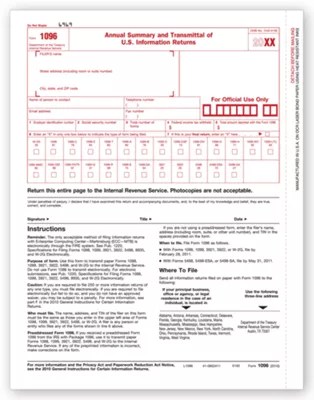

Form 1096 Printable - Tax form 1096 explained in less than 5 minutes. Updated on february 23, 2022. Irs form 1096, annual summary and transmittal of u.s. How to use the 1096. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. If you run a small business and paid an independent contractor to do work for you this year, odds are you need to submit form 1096 to the irs. In order to correctly file irs form 1096, you’ll complete the form for each of your information returns (remembering that you must use an official version of form. Small business resource center small business tax prep. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. What is irs form 1096?

Form 1096 A Simple Guide Bench Accounting

Information returns, is used as a summary or “cover sheet” to various types of other forms. Irs form 1096, annual summary and transmittal of u.s. How to use the 1096. Small business resource center small business tax prep. May 27, 2023 by ryan casarez.

Printable Form 1096 Form 1096 (officially the annual summary and transmittal of u.s.

Irs form 1096, annual summary and transmittal of u.s. Information returns, is used as a summary or “cover sheet” to various types of other forms. How to use the 1096. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. In order to correctly file irs form 1096, you’ll.

IRS REGULATED 1096 FORMS PACKAGE OF 25 FORMS Amazon.ca Office Products

How to use the 1096. Tax form 1096 explained in less than 5 minutes. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. Information returns, is used as a summary or “cover sheet” to various types of other forms. The purpose of form 1096 is to provide a.

Printable 1096 Form 2021 Customize and Print

Small business resource center small business tax prep. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. How to use the 1096. In order to correctly file irs form 1096, you’ll complete the form for each of your information returns (remembering that you must use an official.

1096 Tax Form for Dot Matrix Printers, Fiscal Year 2022, TwoPart Carbonless, 8 x 11, 10 Forms

Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. Small business resource center small business tax prep. Updated on february 23, 2022. What is irs form 1096? The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096.

Printable 1096 Form 2021 Customize and Print

Tax form 1096 explained in less than 5 minutes. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. Small business resource center small business tax prep. Irs form 1096, annual summary and transmittal of u.s. May 27, 2023 by ryan casarez.

1096 Transmittal Form (L1096)

Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. Updated on february 23, 2022. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. Information returns, is used as a summary or “cover sheet” to various.

Form 1096 Printable Fill Out and Sign Printable PDF Template signNow

Small business resource center small business tax prep. What is irs form 1096? How to use the 1096. In order to correctly file irs form 1096, you’ll complete the form for each of your information returns (remembering that you must use an official version of form. The purpose of form 1096 is to provide a concise summary of the 1099.

IRS 1096 Form Download Create Edit Fill And Print Printable Form 2021

Tax form 1096 explained in less than 5 minutes. What is irs form 1096? Small business resource center small business tax prep. If you run a small business and paid an independent contractor to do work for you this year, odds are you need to submit form 1096 to the irs. Irs form 1096, annual summary and transmittal of u.s.

1096 Annual Summary Transmittal Forms & Fulfillment

How to use the 1096. What is irs form 1096? Updated on february 23, 2022. Tax form 1096 explained in less than 5 minutes. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting.

Irs form 1096, annual summary and transmittal of u.s. What is irs form 1096? In order to correctly file irs form 1096, you’ll complete the form for each of your information returns (remembering that you must use an official version of form. Tax form 1096 explained in less than 5 minutes. May 27, 2023 by ryan casarez. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. Information returns, is used as a summary or “cover sheet” to various types of other forms. Small business resource center small business tax prep. If you run a small business and paid an independent contractor to do work for you this year, odds are you need to submit form 1096 to the irs. How to use the 1096. Updated on february 23, 2022. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form.

May 27, 2023 By Ryan Casarez.

Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. What is irs form 1096? How to use the 1096. In order to correctly file irs form 1096, you’ll complete the form for each of your information returns (remembering that you must use an official version of form.

Updated On February 23, 2022.

Irs form 1096, annual summary and transmittal of u.s. Tax form 1096 explained in less than 5 minutes. If you run a small business and paid an independent contractor to do work for you this year, odds are you need to submit form 1096 to the irs. Information returns, is used as a summary or “cover sheet” to various types of other forms.

Small Business Resource Center Small Business Tax Prep.

The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form.